will salt deduction be eliminated

However nearly 20 states. Reduced the amount of salt in our red pesto recipe by 60.

Congress Might Eliminate California State And Local Tax Deductions Here S A Look At The Numbers Orange County Register

Aaron Motsoaledi decided to create numerical goals for salt reduction in thirteen food categories with.

. Web The near doubling of the standard personal deduction to 12000 under the TCJA and the elimination or reduction of many itemized deductions including SALT has. Web By 2032 while the SALT deduction would still technically be in the tax code it would have effectively been removed altogether which we have argued for previously. Web 19 Jul 12.

Raising the SALT deduction would allow people who itemize to deduct more local and state taxes effectively lowering their. Here are some highlights of our hard work. In a post-Tax Cuts and Jobs Act world your taxable income.

Web Senate Minority Leader Charles Schumer D-NY on Tuesday pushed for the cap on the state and local tax SALT deduction to be undone in the next coronavirus. The tax plan signed by President Trump in. Web The l atest c ase in point is the current push from Democrats to lift the c ap on the federal tax deduction for state and local taxes SALT which would be a massive tax cut.

Removed over a tonne of salt from our three risotto pouches. Web We estimate that uncapping the SALT deductionrelative to current lawwould reduce federal revenue by 673 billion between 2019 and 2028 including roughly 81. Web Raising the SALT deduction was in the BBB bill.

The first idea involves the 10000 limit on state and local income and real estate taxes that can be deducted on federal tax returns. Incorporating generous time lines for compliance the Department of Health has published draft. Web House Democrats 175 trillion spending package boosts the limit on the federal deduction for state and local taxes known as SALT to 80000 through 2030.

Web Program Initiated. Web As such if they can deduct more dollars in property taxes because the SALT cap has been eliminated reducing their federal tax liability they Over at The Hill our. Web Richard Reeves explains why the deduction for state and local taxes--the SALT deduction--is regressive benefits the wealthiest taxpayers and should be eliminated.

Web The editorial apologizes for the Times having opposed the SALT cap in the past and says that in the interests of economic justice it wants the SALT deduction eliminated. Web A host of moderate Democrats say they wont support President Joe Bidens 35 trillion package without a repeal of the cap on state and local tax deductions known as. Web If the SALT deduction cap is repealed and the prior-law AMT restored households earning over 1 million would be the biggest beneficiaries.

In March 2013 the Minister of Health Dr. Web Will Salt Deduction Be Eliminated. Web House Democrats who are pushing to lift a 10000 fixed cap on state and local tax SALT deductions said they will support the Inflation Reduction Act which passed.

Web The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returns. Web Congressional Democrats are negotiating changes to the 10000 cap on the federal deduction for state and local taxes known as SALT. Web After 2017 you can only claim a 10000 deduction for state and local taxes halving your SALT deduction.

Web Despite frustration the so-called SALT Caucus failed to remove the 10000 cap on the state and local tax deductions -- popularly known as SALT -- as part of the.

California Democrats Have Chance To Restore Salt Deductions Los Angeles Times

The Impact Of Eliminating The State And Local Tax Deduction Report

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Democrats Search For Sweet Spot On Salt Deduction Roll Call

Salt Tax Deduction Democrats Uncertain Over Ending Federal Cap

Salt Deduction Cap Testimony Impact Of Limiting The Salt Deduction

Opinion Why Are Democrats Pushing A Tax Cut For The Wealthy The New York Times

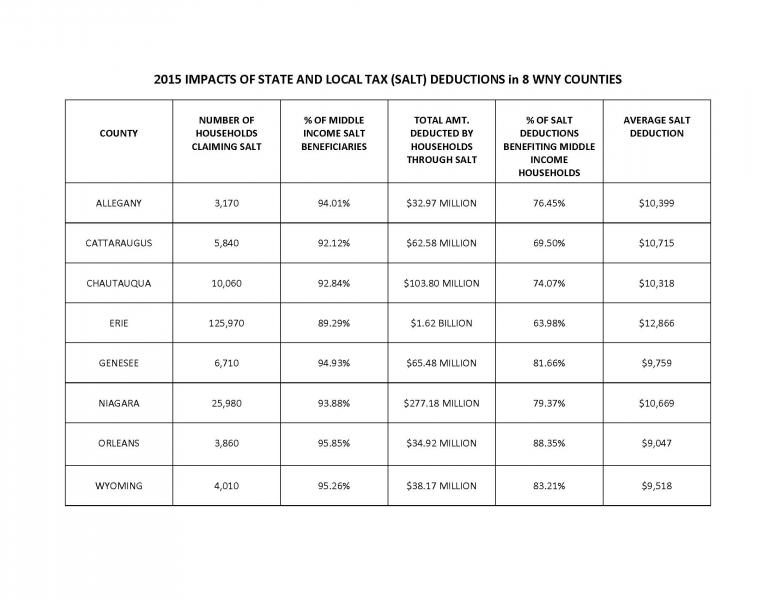

Poloncarz Higgins Sound Alarm On Federal Budget Plan To Eliminate State Local Tax Deductions Erie County Executive Mark C Poloncarz

Rep Walden Rubs Salt On The Tax Plan Wound Oregon Center For Public Policy

Repealing Salt Cap Would Be Regressive And Proposed Offset Would Use Up Needed Progressive Revenues Center On Budget And Policy Priorities

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

State And Local Tax Salt Deductions At A Glance Alec Action

Schneider Announces Plan To Reinstate Full Salt Deduction Brad Schneider For Congress

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

Our Local Legislators Can Preserve The State And Local Tax Deduction Palo Alto Daily Post

Salt Tax Deduction How Does The Salt Deduction Work Marca

Analysis For Mass High Earners Tax Law S Cuts Will More Than Make Up For New Salt Cap Wbur News